A supercharged approach to technology transformation 🚀

The untold story of the 21st Century Fox and Disney transaction, and the spin out of Fox Corporation

The deal between 21st Century Fox and Disney was well documented as it evolved from initial offer at the end of 2017 through to its completion in March 2019. What hasn’t been spoken about so much is the progressive structure of that deal, and how it facilitated a radically new set of technology capabilities in the spin out company, Fox Corporation (🦊$FOXA).

In this edition of Tech Insiders, we discuss the approaches taken during and after this landmark transaction, and share some thoughts a couple of years on around where those decisions took us.

Straight to the punchline - we left almost all of our systems and infrastructure behind and embarked on a two-year journey and radical transformation, which included:

the elimination of all data centers, migrating into an entirely elastic infrastructure;

the construction of a brand new 8K and 5G enabled video distribution and streaming facility, in partnership with AWS and Arizona State University;

the consolidation of a relatively disparate set of enterprise systems and teams into a single, modern, best of breed cloud stack overseen by a single operation team;

an enhanced security posture based upon a zero-trust architecture;

a vastly scaled talent pool of software engineering and product development skills;

and a firm shift toward a growth and enablement mindset across the team.

If any of you reading this are in the midst of a spin out or any form of merger, or if you’re at the helm of a team driving technology transformation we hope you find this insight useful 🙏 .

Let’s dig into the principles we followed during and after this deal was concluded, and dive into some of the outcomes.

1. Be bold with the “end-state” 🔮

Easy to say but hard to do. As we scenario planned, nothing was sacred and everything was put on the table for review - all with the goal of driving a much higher bar around technology talent, more robust and future proof platforms and brand-new software capabilities for the business. We knew what was encumbering velocity and creativity.

We set an idealized vision for a highly progressive, modern tech-stack and that led us to our boldest overarching decision: to include our entire current technology stack by default within the terms of the sale. This then allowed us to selectively claw back some limited but essential capabilities while otherwise committing to build a suite of technical capabilities from scratch to support the new modern company that we were building.

Here’s specifically what that strategy led to:

Re-upped talent: 60% of the new team picked from the previous team, and 40% new hires to bring in new experience and expertise. The new company was due to be about a third of the size of the original company, so this left us with a more concentrated team with the ability to complement pre-existing talent with fresh skills.

Organization simplification: Consolidation of key operations across the company (enterprise technology for example) into one single chain of control and governance - with no exceptions. This led to simplicity in operations, and almost more importantly, a consistent approach to platforms and single platform instances for the entire organization, bringing a range of configuration and security benefits.

Zero legacy: This was a once in a lifetime opportunity to walk away from the legacy platforms that had gathered across the company over many many years. From old ERP and finance systems through to broadcast critical infrastructure - nothing was spared. If it didn’t have an API, couldn’t work in the cloud or was simply insecure, we walked away from it - with no exceptions.

Bridging “back-office” and “front-of-store”: The technology and skills that power the consumer facing digital business and the internal operations were blurring and we leaned heavily into a technology leadership team that was truly ambidextrous, and an infrastructure that was integrated by design. Key themes, such as data platforms and pipelines, video infrastructure and product velocity are finally aligned horizontally across the organization as opposed to vertically.

Capabilities versus cost: We placed the creation of brand-new technology capabilities at the center of the plan, and then ensured that the investment and savings stories aligned. The cart never ever drove the horse, and whilst savings were a natural outcome of the plan, the team was always mobilized to build new capabilities over and above efficiencies.

Looking back, we certainly drew the line in a bold place and to be fair, it was challenged heavily during the finalization of the deal. Were we throwing away crown jewels developed over many years and were we introducing operational risk - and of course the clock was ticking, could we stand up the new platforms in time? All fair questions and whilst this strategy was not for the faint of heart, it was a prize worth chasing.

2. Deal structure buys you optionality 🏗

At FOX, our 💰finance💰 team is - I believe - the best in the business. In the very early days shaping the deal, technology had a voice at the table and factored in some of the ambition and optionality into the terms. This helped us considerably down the road but one core principle in the deal gave us ultimate flexibility. We were hand picking the assets and talent to come with the new company from the ground up and starting with a blank sheet of paper.

This also led to the ability to leave the legacy behind - when you’re building a company from scratch you choose what to bring with you. This sounds obvious but so many M&A transactions are scoped and locked around the assets themselves as opposed to the capabilities needed by the company that is being spun out. The principles that we established in two frantic weeks at the end of 2017 ended up providing us with ultimate flexibility down the road in building the business in a way that was truly fit for the future. The power of this particular point shouldn’t be underestimated, and having a strong technology voice at the deal table is something that is overlooked by many organizations.

3. Maximize the two year ‘window’🪟

Any major M&A deal has a component of crossover known as transition services arrangements (TSAs). In many transactions, these are simply used in a non-strategic way to migrate the ownership of a business safely and efficiently. But looked at strategically, TSAs can be used as a vehicle for giving you the airspace internally to allow the acquirer to run your operational services and legacy technology (and the associated teams) whilst you lay the tracks for the future.

In any technology transformation, you generally have your best people keeping the existing operation running while they also attempt to deliver the new projects and platforms. They’re spread thin, and rarely is there a burning platform or time pressure to move with the sense of urgency that is truly required.

TSA’s are often time capped to two years and have a fixed end date. They also allow your best people to focus entirely on the future as opposed to the present, which provides a unique opportunity to drive the implementation of much more rapid transformation. Just think about that - your best people are working full time on the future as opposed to keeping the day to day running. Our team ran like a start-up making decisions from technical first principles, all within the context of a large corporation with well established brands and businesses.

To be clear, ceding operational control during this window was not without risk and there was some initial skepticism to the strategy. Much of the infrastructure we placed into TSAs was truly mission critical - it powered our Super Bowl coverage, it paid our suppliers and it kept our products, networks and channels going. We were very bold in the approach we took, but one thing here helped significantly. We forged close relationships with the Disney crew (strong shout out to our Disney pals Aaron LaBerge and Chris Lawson) and they (and their teams) understood the gravity of what they were taking on for us. The fact that it had been woven into the original deal principles also helped us considerably as they were progressing down this path.

Moral of the story - TSAs are your friend - use them strategically 😍

4. Delivery…nothing else matters 🐍

Post close, once the gun has fired, you’ve truly got two years to stand up the future. Greenfield is great, until you’ve got to build things in that field.

We moved all of our best lieutenants into delivery roles and focused them in on the work that really mattered for the future. And there’s no bigger example of this during the two-year window than the new video distribution and streaming center that we built in Tempe, Arizona. This included:

The construction of a new 400,000 square foot facility on the ASU Technology Campus;

a massive cloud programme with AWS, deploying existing Elemental technology, peering with their network backbone and developing brand new infrastructure to help produce and stream 8K live video in the AWS cloud

a recruitment drive to hire 200 new engineers;

an enterprise-wide operational overhaul to make the new facility a world class center for multi-platform and company wide technical operations;

the migration of a capability that was once hardware centric towards something that was far more software and platform centric.

This was one of the handful of large projects that we chose to chase and it went live in February this year- with one full month to spare before the TSA expiry 🥵. Fair to say though, absolutely nothing else matters during that two-year window other than the safe and on time delivery of the new team, infrastructure and platforms.

5. Rebalancing the allocation of resources

As we set out the path back in 2019, we had a strong focus on making sure the transformation took us to a place where our team and investment in technology was much more focused on the future growth of the business. This really meant the prioritization of our digital business and the platforms and engineering expertise that drive those businesses.

Significant efficiency was delivered into the core enterprise technology operation through modernization and consolidation. More importantly, the new capabilities delivered through this focus are bringing speed, agility and creative benefits to the company in a way that the old systems and practices just simply couldn’t support.

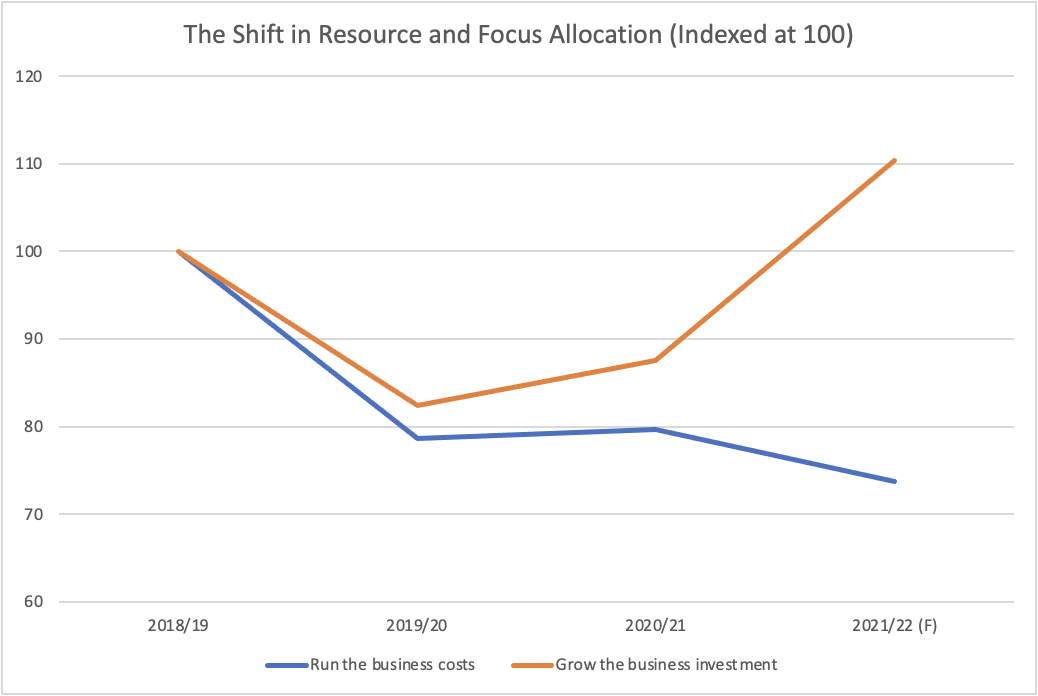

The chart below outlines an index of these costs, effectively moving from the baseline pre-transformation of 100 down to 74 post transformation.

In addition to this, the shift and swing of resources and focus towards the growth activities in the company (largely digital revenues) has been significant. The initial dip between 2018/19 and 2019/20 was caused by a reset in focus and the creation of the 40% capacity for hiring within the team. It was also a factor of the relentless focus on delivery that we’ve just outlined - really, nothing else mattered during that period.

But as the team powered through the transformation, the swing in focus on the growth aspect of the business really started to kick in, moving 28 points in total between 2019/20 and 2021/22(F).

Final thoughts

There are plenty of things we’d have done differently, and of course there are some loose ends that are still being cleared up - we’re not saying that everything went perfectly. But the key perspective here to take away is that a transactional deal, when structured well, can pour jet fuel on your technology transformation plans.

We’d estimate that we completed at least 5+ years of work within the two-year time frame, and that’s placed us in a great position for the future 🚀.

About FOX

We work with the best talent, best partners and the best technologies, and we’re hiring. Come join the most forward leaning technology team in media 😀